|

The health, safety and wellbeing of our staff and clients is extremely important to us. We have adopted the following practices in accordance with the advice of the Federal Government Department of Health so that we can ensure the safety of our staff, clients and other visitors to our office:-

1. We ensure that any employee who is not well, or who have recently returned from overseas, seeks medical advice and, where appropriate, follows the isolation guidelines issued by the Australian Government Department of Health. 2. We provide hand washing facilities and regularly sanitise surfaces, door handles etc in our office. 3. We ask our clients who have returned from overseas in the last 14 days, or who have symptoms associated with the virus to conduct meetings with us by telephone. We are committed to continuing to monitor the situation and adopt the recommendations of The Australian Government Department of Health as applicable. We trust that these measures will be adopted by all and welcome any feedback or questions you may have by contacting Monica McKendry of our office.

0 Comments

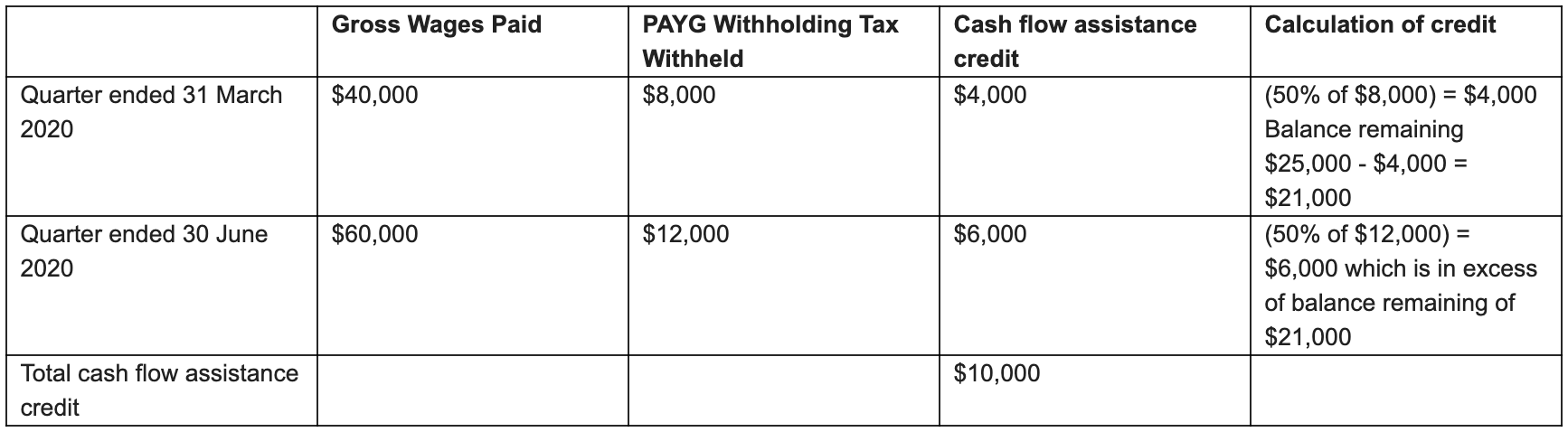

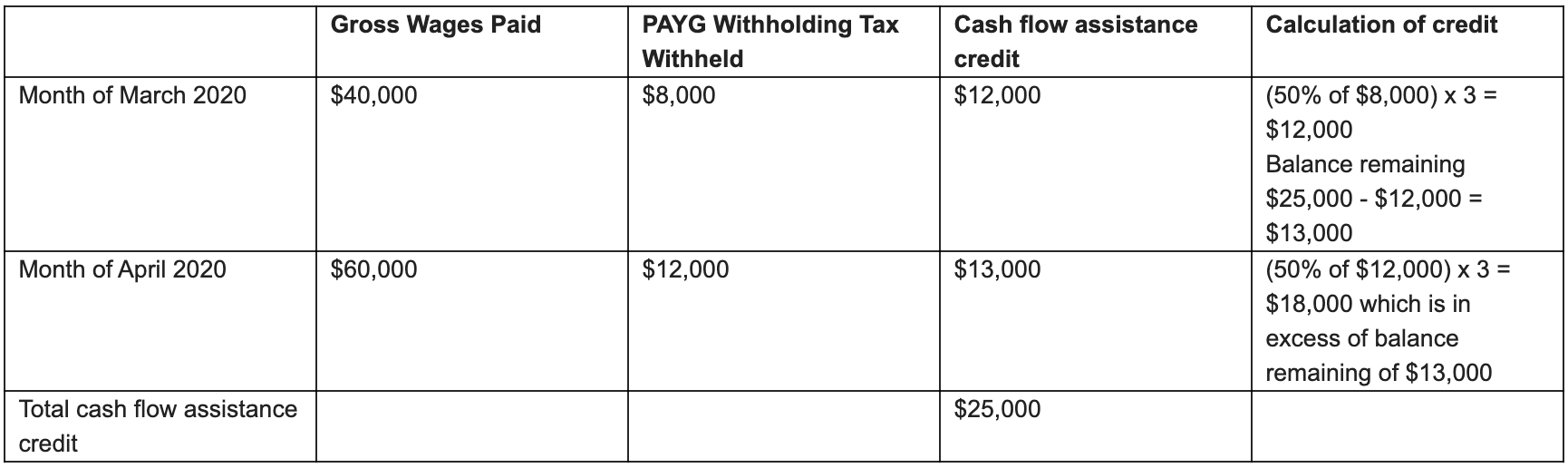

This measure will provide a credit of minimum of $2,000 and a maximum of $25,000 to eligible businesses that employ workers with an annual turnover under $50m. The credit will be applied in the Business Activity Statements for the quarters ending 31 March 2020 and 30 June 2020. Monthly GST or PAYG withholding remitters who lodge Instalment Activity Statements will claim the credit in the activity statements for the months of March, April, May and June 2020. The credit is calculated as the greater of $2,000 and 50% of the amount of PAYG withholding tax withheld from employee’s salary and wages up to a maximum of $25,000. Monthly withholders calculate the credit at three times (150% the rate). The credit will reduce the balance of the business activity statement liability and where this places this places the business in a refund position, the ATO will refund the credit within 14 days. Calculation Examples Quarterly withholder: Monthly withholder: Note:

1. your business does not have to apply for the credit. 2. if your business employs you will receive a credit of at least $2,000. 2. your business may not receive a cash payment if your business GST, PAYG withholding and income tax obligations are greater than the credit. Further information is available from The Australian Government Treasury website here: https://treasury.gov.au/coronavirus/businesses

|

Archives

June 2024

Categories |

Quick Links |

Find Us |

Contact UsPhone: 07 4957 2231

Fax: 07 4951 4382 Email: [email protected] Visit: First Floor, City Plaza 45 Wood St Mackay QLD 4740 Mail: P.O. Box 16 Mackay QLD 4740 |

Follow Us |

RSS Feed

RSS Feed