|

The end of the financial year is fast approaching, and it's time to get your financial affairs in order. As June 30 draws near, preparing for your personal tax return becomes essential. To help you navigate this process smoothly, we've compiled a handy guide with tips on what you need to have ready. Let's dive in and ensure a stress-free tax season!

Organise Your Documentation Gather all the necessary paperwork to support your tax deductions and income records. This includes your bank statements, rental property records, dividend statements, and any other relevant financial documents. Having these organised and easily accessible will save you time and effort when completing your tax return. Review and Pre-fill Your Information The Australian Taxation Office (ATO) pre-fills some information in your tax return, such as salary and wage details, interest income, and government benefits received. Check the accuracy of this information and make any necessary adjustments. By using pre-filled data, you can minimise errors and ensure the completeness of your tax return. You can check your pre-filling information through your myGov account. Explore Deduction Opportunities Take advantage of eligible deductions to reduce your taxable income. Common deductions include work-related expenses (e.g., uniforms, professional development), self-education expenses and charitable donations. Keep receipts and supporting documentation for these expenses to substantiate your claims. Consider Superannuation Contributions Boost your retirement savings while potentially reducing your tax liability by making additional concessional (before-tax) or non-concessional (after-tax) contributions to your superannuation fund. Consult with a financial advisor to determine the best strategy for your circumstances. Seek Professional Guidance If you have complex financial circumstances or are unsure about specific tax matters, consulting a qualified tax professional can provide valuable insights and ensure compliance with relevant regulations. They can assist in maximising your deductions, optimising your tax position, and navigating any changes in tax laws.

0 Comments

In the realm of financial success, businesses and households share more in common than one might think. Just as you meticulously plan and budget for your family's needs and aspirations, your business too requires a solid foundation built on effective financial management. At S.H Tait & Co, we understand the paramount importance of budgeting and goal setting for businesses. Keep reading as we delve into how these practices can pave the way for prosperity and growth, drawing parallels between managing your house and family and managing your business.

Laying the Foundation: Budgeting as the Cornerstone Just as a strong foundation is vital for the stability of your house, a well-constructed budget forms the bedrock of your business's financial well-being. Budgeting allows you to gain a comprehensive understanding of your income, expenses, and cash flow, helping you make informed decisions. By carefully planning and allocating resources, you can avoid unnecessary financial strain, identify areas of potential growth, and effectively manage any unforeseen challenges. Goal Setting: Charting the Path to Success In both your personal life and business, setting clear and achievable goals is imperative. By establishing measurable and realistic objectives for your business, you create a roadmap that helps you stay focused, track progress, and celebrate milestones along the way. Whether it's expanding your market share, increasing profitability, or launching new products/services, setting specific goals allows you to envision success and work towards it strategically. Monitoring and Adjusting: Regular Financial Health Check-ups Just as you regularly evaluate your family's financial health, it's crucial to monitor and assess your business's financial performance. Regularly reviewing your budget and financial statements enables you to identify areas where you're excelling and those that require adjustment. This proactive approach allows you to address potential issues promptly, make necessary course corrections, and seize opportunities for growth. At S.H Tait & Co, our expert accountants can help you analyse your financial data, providing invaluable insights and guidance to keep your business on track. Building Resilience: Creating an Emergency Fund Just as unexpected expenses can arise in your personal life, your business may encounter unforeseen challenges or downturns. By diligently saving and building an emergency fund, you can safeguard your business against sudden shocks, ensuring continuity and stability. This reserve provides a safety net, enabling you to navigate through tough times without compromising your long-term goals. Collaboration with Experts: Partnering with S.H Tait & Co Partnering with a reputable accounting firm like S.H Tait & Co can be a game-changer for your business. By leveraging our expertise, you gain access to tailored solutions, accurate financial reporting, strategic insights, and comprehensive support to help your business thrive. As the financial year ends, business owners must prepare for their tax obligations. The End of Financial Year (EOFY) presents an opportunity to assess your business's financial health, review your tax strategy, and ensure compliance with Australian tax laws. We outline key steps to help you get ready for EOFY.

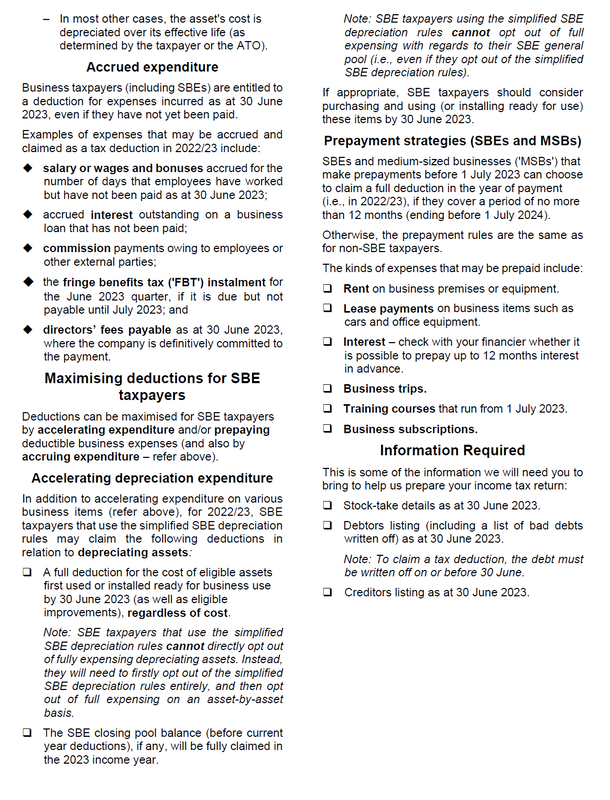

Organise Financial Records Ensure your financial records are accurate, complete, and up-to-date. Gather documents such as income and expense statements, bank statements, payroll records, and invoices. Review and reconcile your accounts, identifying any discrepancies or missing information. Well-organised records will streamline the tax return process and help you track your business's financial performance. Review and Lodge Your Business Activity Statements (BAS) Reconcile your BAS and GST records for the financial year. Check for any outstanding lodgments and ensure your reporting is accurate. If necessary, consult with an accountant to rectify any errors or address complex GST matters. Lodge your BAS on time to avoid penalties. Superannuation Obligations Ensure you have met your superannuation obligations for your employees. Make any outstanding superannuation guarantee contributions by the required due dates to avoid penalties. Lodge the necessary reports and documentation with the ATO. Plan for the New Financial Year EOFY is an ideal time to reflect on your business's performance and set goals for the coming year. Review your financial statements, analyse profitability, and identify areas for improvement. Develop a budget and cash flow forecast to guide your business decisions. Preparing for the End of Financial Year is crucial for individuals and business owners alike. By following these tips, you can streamline your tax obligations, maximise deductions, and ensure compliance with Australian tax regulations. Be proactive, organise your financial records, seek professional guidance when needed, and use this opportunity to set your business finances on the right track for the new financial year. Your Checklist Claims for deductions Receipts for deductions Car claims and log books Please review the information below and contact our office if you need assistance. Tax saving strategies prior to 1 July 2023

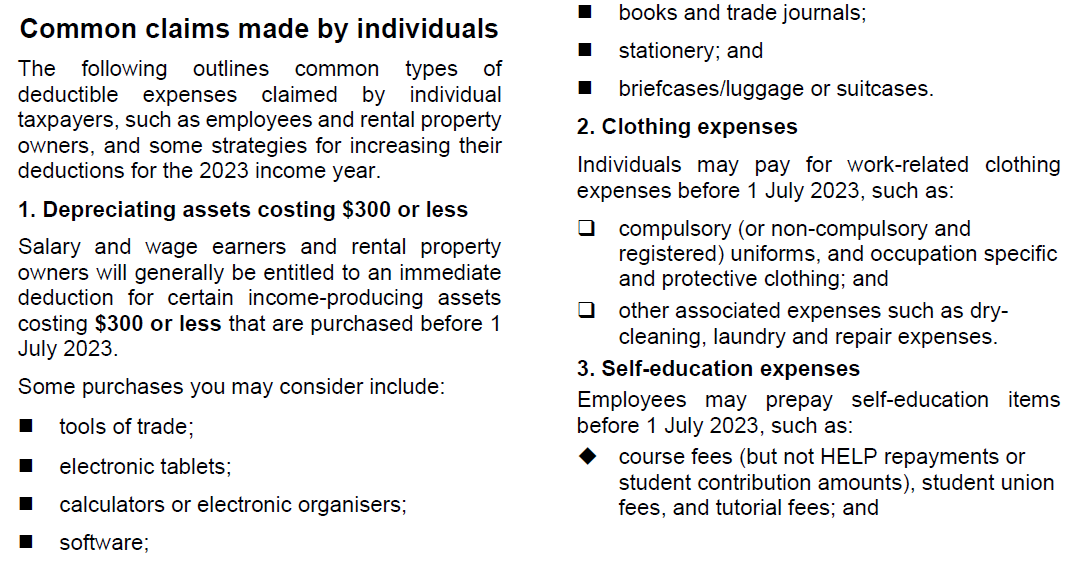

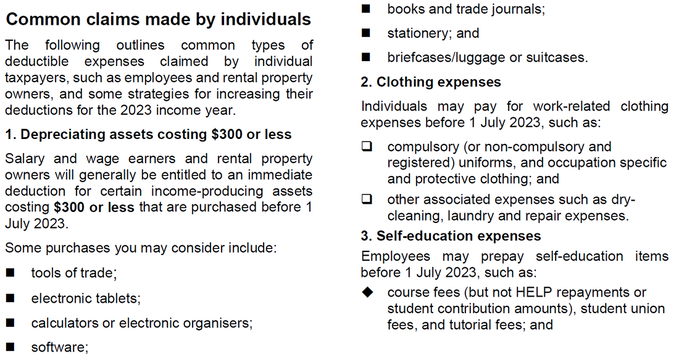

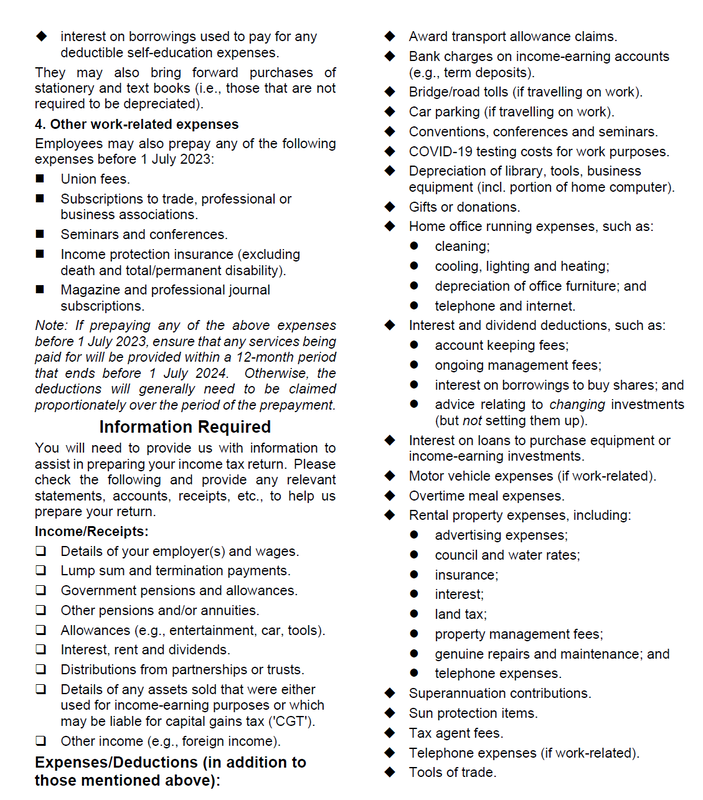

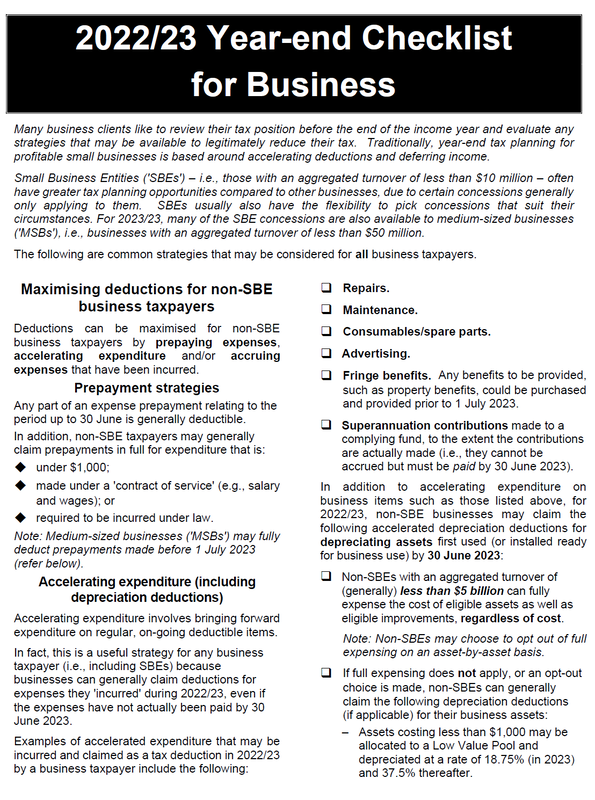

A strategy often used to reduce taxable income (and, in turn, tax payable) in an income year is to bring forward any expected or planned deductible expenditure from a later income year. However, any individuals with potentially reduced income for the 2023 tax season may want to instead consider deferring any deductible expenditure (if possible). 2023/24 Budget Update On 9 May 2023, Treasurer Jim Chalmers handed down the 2023/24 Federal Budget. Some of the measures announced by the Government (including some which were actually announced prior to the Budget), include: from 1 July 2026, employers will be required to pay their employees’ superannuation at the same time as their salary and wages; providing businesses with annual turnover of less than $50 million with an additional 20% deduction on spending that supports electrification and more efficient use of energy (the 'Small Business Energy Incentive'); and increasing the capital works tax deduction depreciation rate for eligible new build-torent projects from 2.5% to 4% per year. In addition to these, one of the most important aspects of this Budget was that the Government has provided some further depreciation relief for small businesses once temporary full expensing comes to an end on 30 June 2023. Specifically, from 1 July 2023 until 30 June 2024, the Government will temporarily increase the instant asset write-off threshold for small businesses (with an aggregated annual turnover of less than $10 million) from $1,000 to $20,000. Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool. Also, the provisions that prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended until 30 June 2024. Other important measures the Government announced include: amending (and limiting) the non-arm’s length income (‘NALI’) provisions which apply to expenditure incurred by superannuation funds; reducing the tax concessions available to individuals with a total superannuation balance exceeding $3 million; and exempting lump sum payments in arrears from the Medicare levy. In the ATO's sights this Tax Time The ATO has announced its three key focus areas for this Tax Time: rental property deductions; work-related expenses; and capital gains tax. ATO Assistant Commissioner Tim Loh said the ATO is continuing to prioritise areas where they often see mistakes being made: "Within these areas, we have identified common mistakes, and are particularly focused on addressing these and supporting taxpayers and registered tax agents to get their claims right this year." However, the ATO also recognises that many people are "doing it tough" this year, and expects fewer people will receive a refund, or they may receive smaller refunds than they were expecting, and more may have tax debts to manage. ATO advice regarding year-end trustee resolutions The ATO has advised that, in the lead up to 30 June, trustee clients who wish to make beneficiaries presently entitled to trust income for the 2023 income year should ensure their trustee resolutions are effective. This includes where trustees may want to make beneficiaries 'specifically entitled' to franked dividends and capital gains included in that income (i.e., where trustees want to 'stream' those classes of income to certain beneficiaries). It is important that trustee clients: check their trust deed to ensure that the intended beneficiaries are within the class of persons entitled to trust income (or of trust capital, if they intend to stream a capital gain that is not income of their trust) and are not excluded from being beneficiaries; comply with any requirements in the trust deed that concern how to validly 'appoint' (or distribute) trust income to beneficiaries; recognise that, for tax law purposes, beneficiaries need to be made presently entitled to trust income by 30 June of the relevant year; are aware that, if they fail to do what is required in a trust deed, or fail to appoint income by 30 June, this may cause outcomes to arise that differ to what they intended. This could include other beneficiaries being assessed on the relevant share of the trust's net (taxable) income (or the trustee being assessed at the top rate of tax); and ensure that resolutions are unambiguous. Side hustles' in the ATO's sights Editor: A recent ATO article highlights the fact that it is increasingly trying to bring more modern techniques of money-making into its tax net . . . ‘Side hustles’ have really grown over the past few years — everything from the gig economy and drop shippers, to content creators and influencers. The ATO recognises that it can be hard to know how to treat income when earning money from side hustles, especially when an individual has several, so the ATO has prepared some tips. First, the individual needs to know if they are 'in business'. If so, they may need to think about registration and tax obligations. If they are not in business, but are looking to start one, they should know how to "set themselves up for success". Also, if a side hustle means the individual is now a director of a company, they must make sure they apply for a director ID (which is free). ATO ride sourcing data-matching program The ATO will acquire ride sourcing data relating to approximately 200,000 individuals to identify individuals that may be engaged in providing ride sourcing services during the 2022/23 financial year. The data items include: identification details (driver identifier, ABN, driver name, birth date, mobile phone number, email address and address); and transaction details (bank account details, aggregated payment details, gross fares, net amount paid to driver, and all other income to which GST may or may not apply) of all payments received in the relevant period. The data will be used to identify and inform ride sourcing providers of their tax obligations as part of information and education campaigns. The intelligence obtained will increase the ATO’s understanding of the behaviours and compliance profiles of individuals and businesses that provide ride sourcing services, and may also be used as part of the methodologies by which the ATO selects taxpayers for compliance activities. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

|

Archives

June 2024

Categories |

Quick Links |

Find Us |

Contact UsPhone: 07 4957 2231

Fax: 07 4951 4382 Email: [email protected] Visit: First Floor, City Plaza 45 Wood St Mackay QLD 4740 Mail: P.O. Box 16 Mackay QLD 4740 |

Follow Us |

RSS Feed

RSS Feed