|

Many of our business clients like to review their tax position before the end of the income year and evaluate any strategies that may be available to legitimately reduce their tax. Traditionally, year-end tax planning for small businesses is based around accelerating deductions and deferring income. However, this year, consideration will also need to be given to the impact of the COVID-19 pandemic. Small Business Entities ('SBEs') – i.e., those with an aggregated turnover of less than $10 million – often have greater tax planning opportunities due to certain concessions only applying to them. Further, SBE taxpayers generally have the flexibility of being able to pick the concessions that suit their circumstances. The following are a number of areas that may be considered for all business taxpayers. Maximising deductions for non-SBE taxpayers Deductions can be maximised for non-SBE business taxpayers by prepaying expenses, accelerating expenditure and/or accruing expenses that have been incurred. Prepayment strategies (non-SBEs) Any part of an expense prepayment relating to the period up to 30 June is generally deductible. In addition, non-SBE taxpayers may generally claim prepayments in full for expenditure that is: – under $1,000; – made under a 'contract of service' (e.g., salary and wages); or – required to be incurred under law. Accelerating expenditure (non-SBEs) Accelerating expenditure involves bringing forward expenditure on regular, on-going deductible items. This is a useful strategy because business taxpayers can generally claim deductions for expenses they 'incurred' during 2020/21, even if the expenses have not actually been paid by 30 June 2021. The following may act as a checklist of possible accelerated expenditure for 2020/21: Depreciating assets - Non-SBEs with an aggregated turnover of (generally) less than $5 billion can fully expense eligible assets, regardless of cost, that were first acquired and used (or installed ready) for business use from 7:30pm (AEDT) on 6 October 2020 to 30 June 2021. Note: Non-SBEs may choose to opt out of full expensing on an asset-by-asset basis. If full expensing does not apply to a particular asset (or an opt-out choice is made), non-SBEs with an aggregated annual turnover of less than $500 million can generally claim: – an immediate deduction for eligible assets costing less than $150,000 that were acquired from 7:30pm (AEDT) on 2 April 2019 to 31 December 2020 and were first used (or installed ready) for business use from 12 March 2020 to 30 June 2021; or – for assets costing $150,000 or more, a 50% accelerated depreciation concession for eligible new assets first held and used (or installed ready) for business use from 12 March 2020 to 30 June 2021 (unless an opt-out choice is made for an asset). Additional possible accelerated expenditure could also include the following:

Accrued expenditure (for all business taxpayers - including SBE taxpayers) Business taxpayers (including SBE taxpayers) are entitled to a deduction for expenses incurred as at 30 June 2021, even if they have not yet been paid. Examples of expenses that may be accrued include: ~ salary or wages and bonuses – the accrued expense for the days that employees have worked but have not been paid as at 30 June 2021; ~ interest – any accrued interest outstanding on a business loan that has not been paid; ~ commissions – where commission payments are owed to employees or other external parties; ~ fringe benefits tax ('FBT') – for example, if an FBT instalment for the June 2021 quarter is due but is not payable until July, it can be accrued and claimed as a tax deduction in 2020/21; and ~ directors’ fees – where a company is definitively committed to the payment of a director’s fee as at 30 June 2021, it can be claimed as a tax deduction. Maximising deductions for SBE taxpayers Deductions can be maximised for SBE taxpayers by accelerating expenditure and/or prepaying deductible business expenses (and also by accruing expenditure - refer above). Accelerating depreciation expenditure (for SBE taxpayers) In addition to accelerating expenditure on various usiness items, SBE taxpayers that use the simplified SBE depreciation rules may claim the following 2021 deductions (if applicable) in relation to depreciating assets: A full deduction for the cost of eligible assets (i.e., regardless of cost) first acquired and first used (or installed ready for use) for business purposes from 7:30pm (AEDT) on 6 October 2020 to 30 June 2021. Note that, SBE taxpayers choosing to use the simplified SBE depreciation regime cannot directly opt out of temporary full expensing (i.e., if it applies). Where temporary full expensing does not apply: An SBE taxpayer may be entitled to claim an immediate deduction for eligible depreciating assets costing less than $150,000 that were first used or (installed ready for use) for business purposes by 30 June 2021 Alternatively, assets costing $150,000 or more are allocated to an SBE taxpayer's general small business pool. Note that, SBE taxpayers using the simplified SBE depreciation regime cannot opt out of temporary full expensing with regards to their general pool. As a result, the closing pool balance (before current year deductions) will be fully claimed in the 2021 income year. Therefore, if appropriate, SBE taxpayers should consider purchasing and using (or installing) these items by 30 June 2021. Prepayment strategies – SBE

SBE taxpayers making prepayments before 1 July 2021 can choose to claim a full deduction in the year of payment where they cover a period of no more than 12 months (ending before 1 July 2022). Otherwise, the prepayment rules are the same as for non-SBE taxpayers. The kinds of expenses that may be prepaid include: Rent on business premises or equipment. Lease payments on business items such as cars and office equipment. Interest – check with your financier to determine if it’s possible to prepay up to 12 months interest in advance. Business trips. Training courses that run from 1 July 2021. Business subscriptions. Information Required This is some of the information we will need you to bring to help us prepare your income tax return: Stock-take details as at 30 June 2021. Debtors listing (including a list of bad debts written off) as at 30 June 2021. Note: In order to claim a deduction, the debt must be written off on or before 30 June. Creditors listing as at 30 June 2021.

0 Comments

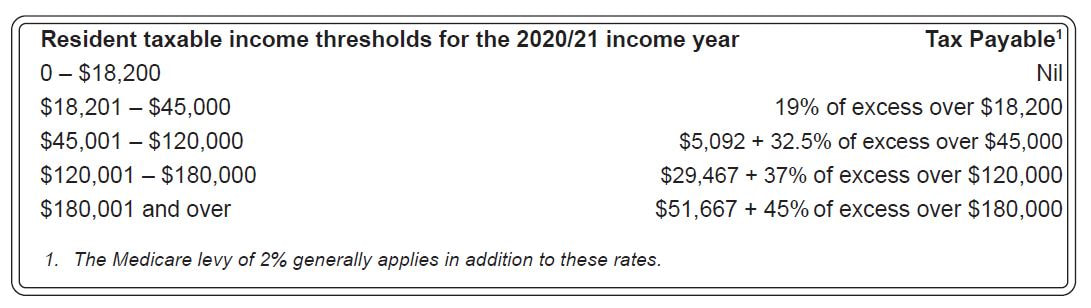

Tax saving strategies prior to 1 July 2021 A strategy often used to reduce taxable income (and, in turn, tax payable) in an income year is to bring forward any expected or planned deductible expenditure from a later income year. However, in light of the continued impact of the COVID-19 pandemic, any tax planning for individuals with potentially reduced income for the 2021 tax season may require consideration of deferring any deductible expenditure (if possible). Common claims made by individuals The following outlines common types of deductible expenses claimed by individual taxpayers, such as employees and rental property owners, and some strategies for increasing their deductions for the 2021 income year. 1. Depreciating assets costing $300 or less Salary and wage earners and rental property owners will generally be entitled to an immediate deduction for certain income-producing assets costing $300 or less that are purchased before 1 July 2021. Some purchases you may consider include: tools of trade; electronic tablets; calculators or electronic organisers; software; books and trade journals; stationary; and briefcases/luggage or suitcases. 2. Clothing expenses Individuals may pay for work-related clothing expenses before 1 July 2021, such as: ~ compulsory (or non-compulsory and registered) uniforms, and occupation specific and protective clothing; and ~ other associated expenses such as drycleaning, laundry and repair expenses. 3. Self-education expenses Employees may prepay self-education items before 1 July 2021, such as: ~ course fees (but not HELP repayments), student union fees, and tutorial fees; and ~interest on borrowings used to pay for any deductible self-education expenses. Also they may bring forward purchases of stationery and text books (i.e., those that are not required to be depreciated). 4. Other work-related expenses Employees may also prepay any of the following expenses before 1 July 2021: ~ Union fees. ~Subscriptions to trade, professional or business associations. ~ Seminars and conferences. ~ Income protection insurance (excluding death and total/permanent disability). ~ Magazine and professional journal subscriptions. Note: If prepaying any of the above expenses before 1 July 2021, ensure that any services being paid for will be provided within a 12-month period that ends before 1 July 2022. Otherwise, the deductions will generally need to be claimed proportionately over the period of the prepayment Information Required You will need to provide us with information to assist in preparing your income tax return. Please check the following and provide any relevant statements, accounts, receipts, etc., to help us prepare your return. Income/Receipts:

Expenses/Deductions (in addition to those mentioned above):

~ cooling and heating; ~ depreciation of office furniture; ~ lighting; and ~ telephone and internet. Interest and dividend deductions, such as: account keeping fees; ongoing management fees; interest on borrowings to buy shares; and advice relating to changing investments (but not setting them up). Interest on loans to purchase equipment or income-earning investments. ~ Motor vehicle expenses (if work-related). ~ Overtime meal expenses. ~ Rental property expenses, including:

~ Sun protection items. ~ Tax agent fees. ~ Telephone expenses (if work-related). ~ Tools of trade. Cryptocurrency under the microscope this tax time The ATO is concerned that many taxpayers believe their cryptocurrency gains are tax-free, or only taxable when the holdings are cashed back into Australian dollars. ATO data analysis shows a dramatic increase in trading since the beginning of 2020, and has estimated that there are over 600,000 taxpayers that have invested in crypto-assets in recent years. This year, the ATO will be writing to around 100,000 taxpayers with cryptocurrency assets explaining their tax obligations and urging them to review their previously lodged returns. The ATO also expects to prompt almost 300,000 taxpayers as they lodge their 2021 tax return to report their cryptocurrency capital gains or losses. Gains from cryptocurrency are similar to gains from other investments, such as shares. CGT also applies to the disposal of non-fungible tokens ('NFTs'). The ATO matches data from cryptocurrency designated service providers to individuals’ tax returns, helping it to ensure investors are paying the right amount of tax. “The best tip to nail your cryptocurrency gains and losses is to keep accurate records including dates of transactions, the value in Australian dollars at the time of the transactions, what the transactions were for, and who the other party was, even if it’s just their wallet address,” Assistant Commissioner Tim Loh said. Businesses or sole traders that are paid cryptocurrency for goods or services will have these payments taxed as income based on the value of the cryptocurrency in Australian dollars. Holding a cryptocurrency for at least 12 months as an investment may mean the holder is entitled to a CGT discount if they have made a capital gain. Temporary reduction in pension minimum drawdown rates extended The Government has announced an extension of the temporary reduction in superannuation minimum drawdown rates for a further year to 30 June 2022. As part of the response to the coronavirus pandemic (and the negative effect on the account balance of superannuation pensions), the Government reduced the superannuation minimum drawdown rates by 50% for the 2019/20 and 2020/21 income years. This 50% reduction will now be extended to the 2021/22 income year. Super Guarantee rate rising from 1 July 2021 The super guarantee rate will rise from 9.5% to 10% on 1 July 2021, so businesses with employees will need to ensure their payroll and accounting systems are updated to incorporate the increase to the super rate. ATO warns on ‘copy/pasting’ claims The ATO is alerting taxpayers that its sights are set on work-related expenses like car and travel claims that are predicted to decrease in this year’s tax returns. Assistant Commissioner Tim Loh noted that COVID-19 has changed people’s work habits, so the ATO expects their work-related expenses will reflect this. “We know many people started working from home during COVID-19, so a jump in these claims is expected,” Mr Loh said. “But, if you are working at home, we would not expect to see claims for travelling between worksites, laundering uniforms or business trips.” The ATO will also look closely at anyone with significant working from home expenses, that maintains or increases their claims for things like car, travel or clothing expenses: “You can’t simply copy and paste previous year’s claims without evidence.” “But we know some of these unusual claims may be legitimate. So, if you explain your claim with evidence, you have nothing to fear.” Family assistance payments The ATO has reminded individuals receiving Child Care Subsidy and Family Tax Benefit payments from Services Australia that they and their partners must lodge their 2019/20 Individual tax returns by 30 June 2021. Lodgment deferrals with the ATO do not alter this requirement. Services Australia needs such individuals' income details to balance payments for Child Care Subsidy and Family Tax Benefit. If tax return lodgment is not made by 30 June 2021: clients receiving Child Care Subsidy may lose their ongoing entitlement and/or receive a debt from Services Australia and have to repay the amount received in the 2019/20 financial year; and clients receiving Family Tax Benefit may miss out on additional payments, may also receive a debt from Services Australia and/or may have their fortnightly payments stopped. Do you use the Small Business Superannuation Clearing House? The ATO has advised employers intending to claim a tax deduction for super payments that they make for employees in the 2020/21 income year that any such payments must be accepted by the Small Business Superannuation Clearing House ('SBSCH') on or before 23 June 2021. This allows processing time for the payments to be received by their employees' super funds before the end of the 2020/21 income year. Car parking threshold for 2022 FBT year The car parking threshold for the FBT year commencing on 1 April 2021 is $9.25. This replaces the amount of $9.15 that applied in the previous FBT year commencing 1 April 2020. Luxury car tax thresholds The ATO has updated the luxury car tax ('LCT') thresholds for the 2021/22 financial year. The LCT threshold for fuel efficient vehicles in 2021/22 is $79,659 (up from $77,565 in 2020/21) and the LCT threshold for other vehicles in 2021/22 is $69,152 (up from $68,740 in 2020/21). Note that these thresholds determine whether LCT is payable, and are different from the luxury car depreciation limit of $60,733 for 2021/22. New ATO data-matching programs involving property The ATO has advised that it will engage in two new data matching programs dealing with property transactions, as outlined below: The ATO will acquire property management data from property management software providers for the 2018/19 through to 2022/23 financial years (relating to approximately 1.6 million individuals); and The ATO will acquire rental bond data relating to approximately 350,000 individuals from state and territory rental bond regulators bi-annually through to 30 June 2023. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances

Get ready for the new financial year The countdown to 30 June has begun. The Federal Government confirmed that the $1,080 low and middle income tax offset will be extended to the year ending 30 June 2021. Eligible taxpayers must lodge their 2021 return to claim the rebate. You can lodge your 2021 tax return after 1 July 2021. As usual, the new financial year brings new tax rules. Some of the big changes that take place on 1 July include: 1. Increase to the superannuation guarantee contribution rate. The minimum super contribution rate will increase from 9.5% to 10%. Clients who charge out labour should review their rates and factor this increase into their rates going forward. 2. Increase to the concessional and non-concessional superannuation caps. The annual concessional or tax deductible cap goes from $25,000 to $27,500. Depending on your total superannuation balance your non-concessional annual cap may increase from $100,000 to $110,000. 3. Single touch payroll (STP) reporting Most businesses have been reporting their wages through STP for two years. The exemptions for micro and family employers run out on 30 June and from 1 July all employers will need to report wages through STP. |

Archives

June 2024

Categories |

Quick Links |

Find Us |

Contact UsPhone: 07 4957 2231

Fax: 07 4951 4382 Email: [email protected] Visit: First Floor, City Plaza 45 Wood St Mackay QLD 4740 Mail: P.O. Box 16 Mackay QLD 4740 |

Follow Us |

RSS Feed

RSS Feed