|

Appointing an SMSF auditor The ATO reminds SMSF trustees that they need o appoint an approved SMSF auditor for each income year, no later than 45 days before they need to lodge their SMSF annual return. An SMSF’s audit must be finalised before the trustees lodge their SMSF annual return, as the trustees will need some information from the audit report to complete the annual return. An SMSF’s auditor is to perform a financial and compliance audit of the SMSF’s operations before lodging. An audit is required even if no contributions or payments are made in the financial year. An approved SMSF auditor must be independent, which means that an auditor should not audit a fund where they hold any financial interest in the fund, or have a close personal or business relationship with members or trustees. If a fund doesn’t meet the rules for operating an SMSF, the auditor may be required to report any contraventions to the ATO. ATO gives 'green light' to lodge The ATO is giving taxpayers with simple affairs the ‘green light’ to lodge their annual income tax returns. ATO Assistant Commissioner Tim Loh said that most taxpayers with simple affairs will find the information they need to lodge has now been prefilledvin their tax return. Mr Loh also reminded taxpayers that some income may need to be manually added – for example, income from rental properties, some government payments or income from ‘side hustles’. As taxpayers prepare to lodge, they should keep ‘Tim’s tax time tips’ in mind: Include all income: If a taxpayer picked up some extra work, e.g., through online activities, the sharing economy, interest from investments, etc, they will need to include this in their tax return; Assess circumstances that occurred this year: If a taxpayer’s job or circumstances have changed this year, it is important they reflect this in their claims; Records, records, records: To claim a deduction for a work-related expense, taxpayers must have a record to prove it. Wait for notice of assessment: Taxpayers should wait for their notice of assessment before making plans for how they will use any expected tax refund this year; Stay alert to scams: The ATO would never send taxpayers a link to log into the ATO’s online services or ask them to send personal information via social media, email or SMS. The ATO advises that, when taxpayers lodge their own return, the due date for payment is 21 November, regardless of when they lodge, but If they use a registered agent, their due date can be much later. Different meanings of 'dependant' for superannuation and tax purposes On a person’s death, their superannuation benefits can only be paid directly to one or more ‘dependants’ as defined for superannuation purposes, unless they are paid to the deceased’s legal personal representative to be distributed in accordance with the deceased’s Will. Super death benefits can be tax-free to the extent that they are paid (either directly or indirectly) to persons who are ‘dependants’ for tax purposes. However, the meaning of ‘dependant’ differs slightly for superannuation and tax purposes. For superannuation purposes, a ‘dependant’ of the deceased comprises: their spouse (including de facto spouse); their child (of any age); a person in an ‘interdependency relationship’ as defined with the deceased; and a person who was financially dependent on the deceased. However, for tax purposes, a ‘dependant’ (or ‘death benefits dependant’) of the deceased includes their spouse or former spouse (including de facto spouse) and only children under the age of 18. Therefore, super death benefits generally cannot be paid directly to a former spouse, as they are not a dependant for super purposes. Also, while a child of any age is a dependant for super purposes, only children under the age of 18 are dependants for tax purposes. This means that, while a child of any age may receive super death benefits directly, those benefits will generally only be tax-free if the child is under 18. NALI provisions did not apply to loan structure The Administrative Appeals Tribunal (‘AAT’) has held that interest income derived by a selfmanaged superannuation fund (‘SMSF’) as the sole beneficiary of a unit trust was not non-arm’s length income (‘NALI’), and so this income could still be treated as exempt current pension income. During the 2015, 2016 and 2017 financial years, the unit trust lent money through two related entities to independent third parties who undertook development activities, through a series of loan arrangements. The interest income derived by the unit trust through these loan arrangements was distributed to the SMSF as sole unitholder and was treated as exempt current pension income. Following an audit, the ATO determined that the income was NALI, and therefore should not have been included as exempt current pension income. The ATO then issued amended assessments for the relevant financial years, along with penalties. While the AAT found that the parties were not dealing with each other at arm’s length, it also concluded that the income that the unit trust derived was not more than the amount it might have been expected to derive if the parties had been dealing at arm’s length. Accordingly, the relevant interest income received by the SMSF was not NALI, and so the taxpayer’s objections to the amended tax assessments and penalties were allowed. Luxury car tax: determining a vehicle's principal purpose The ATO recently explained how to determine the principal purpose of a car for ‘luxury car tax’ (‘LCT’) purposes (since LCT is not payable on the supply or importation of cars whose principal purpose is the carriage of goods rather than passengers). Broadly, a luxury car (i.e., a car subject to LCT) is a car whose LCT value exceeds the LCT threshold. However, a commercial vehicle that is not designed for the principal purpose of carrying passengers is specifically excluded as a luxury car. The ATO’s new determination sets out various factors to be considered in determining the principal purpose of a car, as well as factors to consider when assessing a car’s modifications. The determination states that commercial vehicles are unlikely to have the body types of station wagons, off-road passenger wagons, passenger sedans, people movers or sports utility vehicles, and the supply of these vehicles for an amount above the LCT threshold without LCT being paid may well attract the ATO’s scrutiny. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

0 Comments

Claiming GST credits for employee expense reimbursements Employers may be entitled to claim GST input tax credits for payments they have made to reimburse employees for expenses that are directly related to their business activities. A 'reimbursement' is provided when a taxpayer pays their employee the amount, or part of the amount, of a particular work-related purchase they make. Employers are not entitled to a GST input tax credit if they pay their employee an allowance, or make a payment based on a notional expense, such as a cents-per-kilometre payment, travel or meal allowance. An 'allowance' is provided when a taxpayer pays their employee an amount for an estimated expense without requiring them to repay any excess. Taxpayers are expected to hold sufficient evidence to substantiate their claim, such as a tax invoice for the purchase that is being reimbursed. Lodging of Taxable payments annual reports The ATO reminds taxpayers that it is now time for them to check if their business needs to lodge a Taxable payments annual report (‘TPAR’) for payments made to contractors providing the following services: (a) building and construction; (b) cleaning; (c) courier and road freight; (d) information technology; and (e) security, investigation or surveillance. TPARs are due on 28 August each year and penalties may apply if they are not lodged on time. Taxpayers can help prepare for their TPAR by keeping records of all contractor payments. Taxpayers that do not need to lodge a TPAR this year can submit a TPAR non-lodgment advice form to let the ATO know and avoid unnecessary follow-up. Taxpayers can refer to the ATO’s website for more information about TPARs, including who needs to report and how to lodge. Changes to deductions this tax time Taxpayers who are small business owners operating from home, or who use a vehicle for business purposes, need to be aware of some changes when claiming deductions this tax time, including the following. Cents-per-kilometre method – The cents-perkilometre method for claiming car expenses increased from 72 cents to 78 cents per kilometre in the 2023 income year. For taxpayers using this method, the 78 cents per kilometre rate covers all their vehicle running expenses, including registration, fuel, servicing, insurance, and depreciation. Taxpayers using this method cannot claim these costs separately. Car limit for business owners – The car limit has also increased to $64,741 for the 2023 income year. The car limit is the maximum value taxpayers can use to work out the depreciation of passenger vehicles (excluding motorcycles or similar vehicles) designed to carry a load of less than one tonne and fewer than nine passengers. Work from home business expenses – For the 2023 income year, the 'fixed rate method' (for taxpayers operating their business from home) increased from 52 cents to 67 cents per hour worked from home, and taxpayers are no longer required to have a dedicated home office space. The fixed rate method covers electricity, gas, stationery, computer consumables, internet, and phone usage. Taxpayers can also claim separate deductions for expenses not included in the hourly rate, such as the decline in value of depreciating assets, e.g., laptops or office furniture. Please contact our office for any help with these claims, including record-keeping requirements. Downsizer contribution measure eligibility has been extended The downsizer contribution concession was introduced to allow older Australians selling an eligible dwelling to make additional contributions into their superannuation fund. Broadly, the downsizer contribution concession allows eligible individuals to make non-deductible contributions of up to $300,000 (or up to $600,000 per couple) from the sale of an eligible dwelling that was used as their main residence. The downsizer contribution concession is an attractive option for eligible individuals to boost their superannuation entitlements, as it is not counted towards an individual's standard contribution caps. Also, the total superannuation balance restriction does not apply in respect of a downsizer contribution (so an eligible individual can make a downsizer contribution into their super fund, regardless of their total superannuation balance), and it is not included in the assessable income of the receiving fund. However, there are various eligibility requirements that need to be satisfied in order for a downsizer contribution to be made, and professional advice should be sought in this regard as required. Importantly, as from 1 January 2023, the Government has broadened access to the downsizer contribution concession by reducing the minimum age requirement for accessing this concession from age 60 to age 55. This means that individuals aged 55 to 59 years who were not previously eligible to make downsizer contributions due to their age are now eligible to make downsizer contributions if they satisfy all the eligibility requirements. Reallocation of excess concessional contributions denied The Administrative Appeals Tribunal (‘AAT’) has held that there were no special circumstances in relation to a taxpayer who made excess concessional contributions in a financial year, such that the ATO could allocate some of those contributions to the previous financial year. On Wednesday, 26 June 2019, the taxpayer arranged for contributions totalling just under $25,000 to be made to his superannuation fund, via a direct debit from his bank account to a clearing house used by his fund. However, the relevant contribution was received by the superannuation fund on Monday 1 July 2019. The taxpayer then made further contributions totalling just under $25,000 to his superannuation fund on 5 August 2019, which meant that he had made excess concessional contributions for the 2020 financial year. The AAT confirmed the ATO’s decision that the circumstances did not justify some or all of the contributions made by the taxpayer on 26 June 2019 being reallocated to the 2019 financial year. That is, there were no ‘special circumstances’ (as required by the relevant legislation) that would justify the exercise of the ATO’s discretion to allocate the contributions to the previous financial year. While the AAT accepted that the taxpayer genuinely intended that his contribution would be received by his superannuation fund by 30 June 2019, he should not have waited until 26 June 2019 to make the contribution, as “there was nothing unusual about the time taken to process the ... payment made on 26 June 2019.” Also, in relation to various events and actions of other parties that the taxpayer submitted constituted ‘special circumstances’, the AAT noted that “an error on the part of a third party will not on its own amount to special circumstances.” Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

Court penalises AMP $24 million for charging deceased customers The Federal Court has found that four companies that are or were part of the AMP Group breached the law when charging life insurance premiums and advice fees from the superannuation accounts of more than 2,000 deceased customers. The Federal Court ordered two of these AMP companies to pay a combined penalty of $24 million for the breaches. Both AMP Life Limited and AMP Financial Planning admitted that they engaged in unconscionable conduct by deducting and/or failing to properly refund insurance premiums and advice fees respectively from superannuation members after being notified of their deaths. Both companies also admitted that they accepted insurance premiums and advice fees despite there being reasonable grounds for believing that they would not be able to supply the insurance or advice. The Court also found all four AMP companies contravened their overarching obligations as Australian financial services licensees to act efficiently, honestly and fairly. The super guarantee rate is increasing Businesses that have employees, or hire eligible contractors, will need to ensure that their payroll and accounting systems are updated to reflect the new super guarantee rate of 11% for payments of salary and wages that are made from 1 July 2023. Businesses need to calculate super contributions at 11% for their eligible workers for payments of salary and wages they make from this date. Super contributions for the quarter ending 30 June (due by 28 July 2023) are still calculated at the 10.5% rate for payments of salary and wages made prior to 1 July. Minimum annual payments for super income streams The ATO reminds taxpayers that an SMSF must pay a minimum amount each year to a member who is receiving a pension that commenced on or after 20 September 2007 (e.g., account based pensions). If the minimum payment is not made by 30 June, this can result in adverse taxation consequences for the member. In response to COVID-19, the government temporarily reduced superannuation minimum drawdown requirements for account-based pensions and similar products by 50% for the 2020, 2021, 2022 and 2023 financial years. However, for the 2024 financial year, the 50% reduction in the minimum pension drawdown rate will no longer apply. This means that, from 1 July 2023, when taxpayers calculate the minimum annual payment for their pension, the 50% reduction will not apply to the calculated minimum annual payment. Contact our office if you require assistance in determining the minimum pension payment that must be made in the 2024 financial year. Know your private company loan arrangements before you lodge The ATO advises taxpayers that, if they or an associate take a loan from their private company, they should not forget the requirements of repaying a private company loan for income tax purposes. Otherwise, they could find the loan treated as a Division 7A deemed dividend and included in their, or their associates', assessable income. Taxpayers should consider the following in particular before lodging their private company tax return: ensure their loan is a Division 7A complying loan and make minimum yearly repayments; and they can’t borrow further money or assets from the same company, directly or indirectly, to make minimum yearly repayments or repay the loan – if they do, these payments may not be taken into account and could result in an assessable deemed dividend. The ATO encourages taxpayers to check their loan repayments and, if they are concerned a payment will not be taken into account, they should speak to their registered tax adviser or contact the ATO. Proportional indexation of transfer balance caps from 1 July 2023 The ATO reminds taxpayers that, on 1 July 2023, the general transfer balance cap will be indexed. Individuals will have a personal transfer balance cap between $1.6 and $1.9 million, based on the highest ever balance of their transfer balance account between 1 July 2017 and 30 June 2023. While indexation will occur on 1 July 2023, the ATO won't be displaying member’s updated personal transfer balance caps until 11 July 2023. The ATO encourages all SMSFs to report any events that occurred prior to 1 July 2023 by 30 June 2023, to ensure member’s personal transfer balance cap calculations are based on correct and up to date information. From 11 July, both members and their agents will be able to view the member’s personal transfer balance cap on the ATO’s website. After 11 July 2023, a member's personal transfer balance cap will be recalculated if the ATO receives reporting of events effective prior to 1 July 2023. Individuals can continue to report transfer balance cap information to the ATO between 1 July 2023 and 11 July 2023, however these will not be processed until after this period. This means the ATO won't be able to issue or revoke excess transfer balance determinations it has sent to a member, or commutation authorities it has sent to a fund. Processing of any reported events will continue as normal after 11 July 2023. Masters course fees not deductible as self-education expenses The Administrative Appeals Tribunal (‘AAT’) has held that tuition fees for a public policy Masters course were not deductible, on the basis that the course did not relate to the taxpayer's work as a music teacher. The taxpayer was a qualified teacher who specialised in teaching music. He had commenced a Masters Course at the University of Melbourne (the Masters course), and subsequently claimed a deduction for workrelated education expenses in relation to the subject tuition fees. The taxpayer submitted that the Masters course would expand the breadth of subjects he could teach and therefore help him secure management positions. However, the ATO disallowed the deduction as it was not satisfied that a real and direct connection existed between the study and the taxpayer's work. The AAT confirmed the ATO’s decision that the fees were not deductible as self-education expenses, as the tuition fees were not incurred in gaining or producing the taxpayer's assessable income. The subjects undertaken by the taxpayer in the 2021 year, for which he was seeking to claim a deduction, "did not maintain or improve his skills or knowledge as either a music teacher or relief teacher". The AAT also noted that, in incurring the claimed self-education expenses, the taxpayer’s intention “of being able to expand his ability to teach in subjects outside of music and to gain leadership positions relate to new employment or new income-earning activities and as such is not sufficient basis for those expenses to be deductible”. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

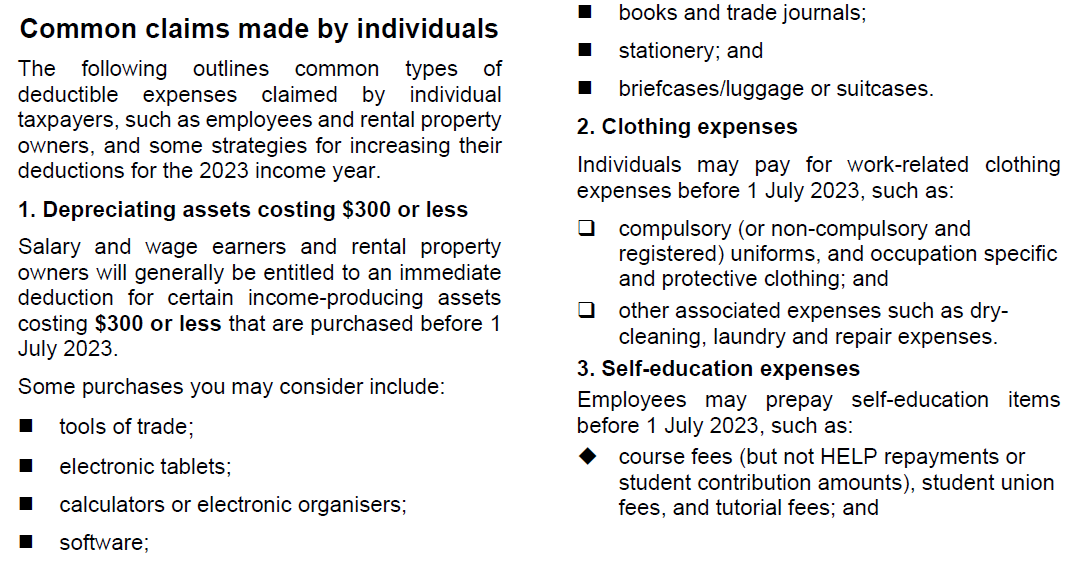

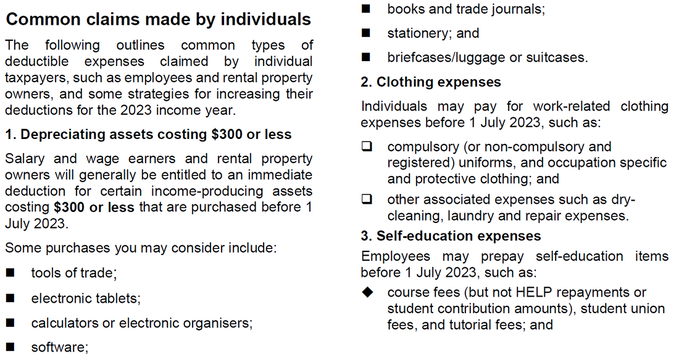

The end of the financial year is fast approaching, and it's time to get your financial affairs in order. As June 30 draws near, preparing for your personal tax return becomes essential. To help you navigate this process smoothly, we've compiled a handy guide with tips on what you need to have ready. Let's dive in and ensure a stress-free tax season!

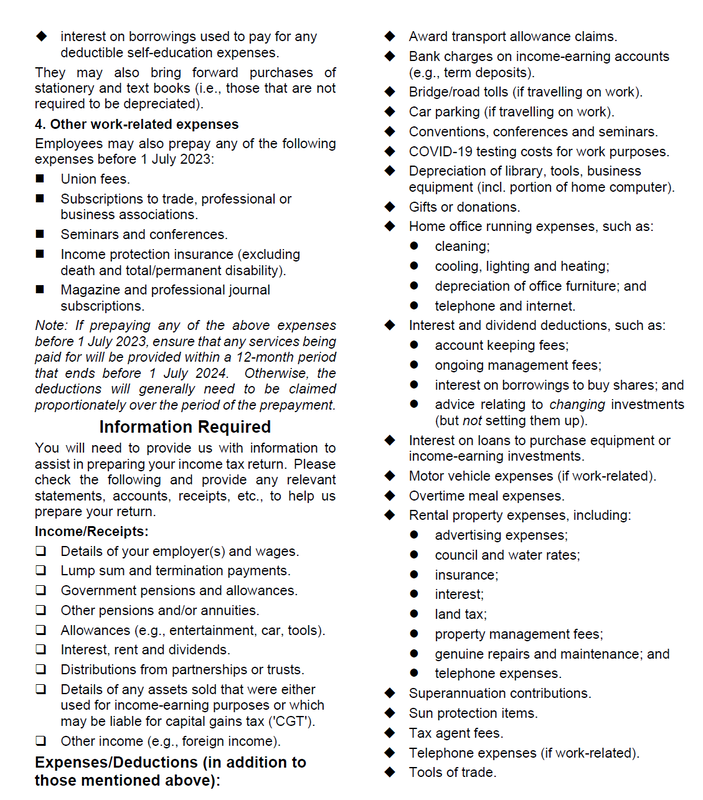

Organise Your Documentation Gather all the necessary paperwork to support your tax deductions and income records. This includes your bank statements, rental property records, dividend statements, and any other relevant financial documents. Having these organised and easily accessible will save you time and effort when completing your tax return. Review and Pre-fill Your Information The Australian Taxation Office (ATO) pre-fills some information in your tax return, such as salary and wage details, interest income, and government benefits received. Check the accuracy of this information and make any necessary adjustments. By using pre-filled data, you can minimise errors and ensure the completeness of your tax return. You can check your pre-filling information through your myGov account. Explore Deduction Opportunities Take advantage of eligible deductions to reduce your taxable income. Common deductions include work-related expenses (e.g., uniforms, professional development), self-education expenses and charitable donations. Keep receipts and supporting documentation for these expenses to substantiate your claims. Consider Superannuation Contributions Boost your retirement savings while potentially reducing your tax liability by making additional concessional (before-tax) or non-concessional (after-tax) contributions to your superannuation fund. Consult with a financial advisor to determine the best strategy for your circumstances. Seek Professional Guidance If you have complex financial circumstances or are unsure about specific tax matters, consulting a qualified tax professional can provide valuable insights and ensure compliance with relevant regulations. They can assist in maximising your deductions, optimising your tax position, and navigating any changes in tax laws. In the realm of financial success, businesses and households share more in common than one might think. Just as you meticulously plan and budget for your family's needs and aspirations, your business too requires a solid foundation built on effective financial management. At S.H Tait & Co, we understand the paramount importance of budgeting and goal setting for businesses. Keep reading as we delve into how these practices can pave the way for prosperity and growth, drawing parallels between managing your house and family and managing your business.

Laying the Foundation: Budgeting as the Cornerstone Just as a strong foundation is vital for the stability of your house, a well-constructed budget forms the bedrock of your business's financial well-being. Budgeting allows you to gain a comprehensive understanding of your income, expenses, and cash flow, helping you make informed decisions. By carefully planning and allocating resources, you can avoid unnecessary financial strain, identify areas of potential growth, and effectively manage any unforeseen challenges. Goal Setting: Charting the Path to Success In both your personal life and business, setting clear and achievable goals is imperative. By establishing measurable and realistic objectives for your business, you create a roadmap that helps you stay focused, track progress, and celebrate milestones along the way. Whether it's expanding your market share, increasing profitability, or launching new products/services, setting specific goals allows you to envision success and work towards it strategically. Monitoring and Adjusting: Regular Financial Health Check-ups Just as you regularly evaluate your family's financial health, it's crucial to monitor and assess your business's financial performance. Regularly reviewing your budget and financial statements enables you to identify areas where you're excelling and those that require adjustment. This proactive approach allows you to address potential issues promptly, make necessary course corrections, and seize opportunities for growth. At S.H Tait & Co, our expert accountants can help you analyse your financial data, providing invaluable insights and guidance to keep your business on track. Building Resilience: Creating an Emergency Fund Just as unexpected expenses can arise in your personal life, your business may encounter unforeseen challenges or downturns. By diligently saving and building an emergency fund, you can safeguard your business against sudden shocks, ensuring continuity and stability. This reserve provides a safety net, enabling you to navigate through tough times without compromising your long-term goals. Collaboration with Experts: Partnering with S.H Tait & Co Partnering with a reputable accounting firm like S.H Tait & Co can be a game-changer for your business. By leveraging our expertise, you gain access to tailored solutions, accurate financial reporting, strategic insights, and comprehensive support to help your business thrive. As the financial year ends, business owners must prepare for their tax obligations. The End of Financial Year (EOFY) presents an opportunity to assess your business's financial health, review your tax strategy, and ensure compliance with Australian tax laws. We outline key steps to help you get ready for EOFY.

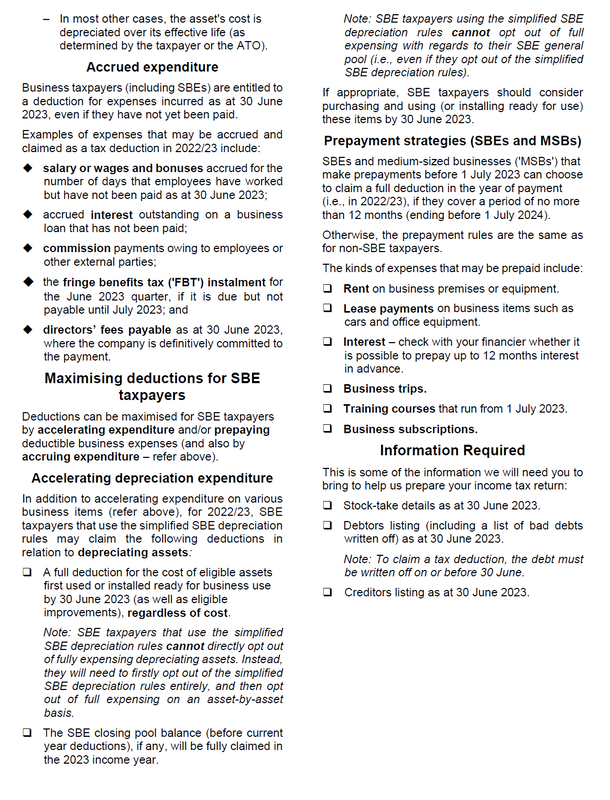

Organise Financial Records Ensure your financial records are accurate, complete, and up-to-date. Gather documents such as income and expense statements, bank statements, payroll records, and invoices. Review and reconcile your accounts, identifying any discrepancies or missing information. Well-organised records will streamline the tax return process and help you track your business's financial performance. Review and Lodge Your Business Activity Statements (BAS) Reconcile your BAS and GST records for the financial year. Check for any outstanding lodgments and ensure your reporting is accurate. If necessary, consult with an accountant to rectify any errors or address complex GST matters. Lodge your BAS on time to avoid penalties. Superannuation Obligations Ensure you have met your superannuation obligations for your employees. Make any outstanding superannuation guarantee contributions by the required due dates to avoid penalties. Lodge the necessary reports and documentation with the ATO. Plan for the New Financial Year EOFY is an ideal time to reflect on your business's performance and set goals for the coming year. Review your financial statements, analyse profitability, and identify areas for improvement. Develop a budget and cash flow forecast to guide your business decisions. Preparing for the End of Financial Year is crucial for individuals and business owners alike. By following these tips, you can streamline your tax obligations, maximise deductions, and ensure compliance with Australian tax regulations. Be proactive, organise your financial records, seek professional guidance when needed, and use this opportunity to set your business finances on the right track for the new financial year. Your Checklist Claims for deductions Receipts for deductions Car claims and log books Please review the information below and contact our office if you need assistance. Tax saving strategies prior to 1 July 2023

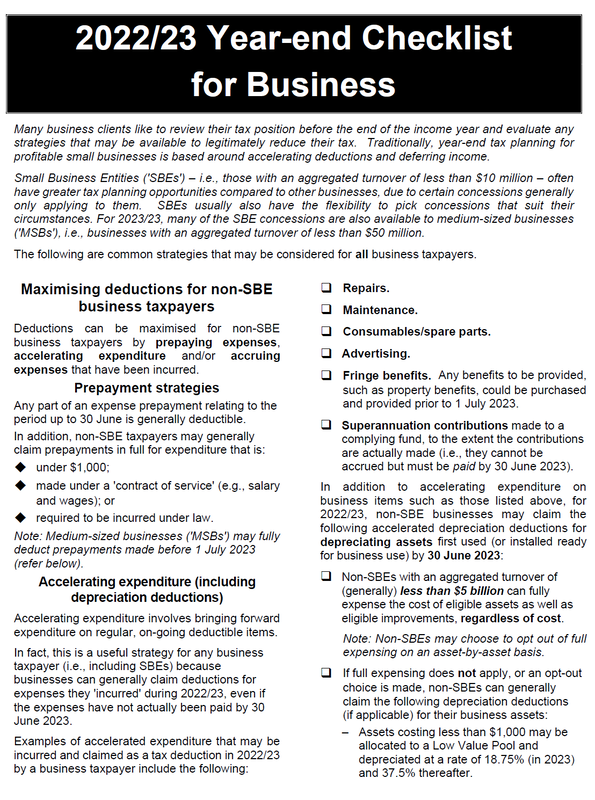

A strategy often used to reduce taxable income (and, in turn, tax payable) in an income year is to bring forward any expected or planned deductible expenditure from a later income year. However, any individuals with potentially reduced income for the 2023 tax season may want to instead consider deferring any deductible expenditure (if possible). 2023/24 Budget Update On 9 May 2023, Treasurer Jim Chalmers handed down the 2023/24 Federal Budget. Some of the measures announced by the Government (including some which were actually announced prior to the Budget), include: from 1 July 2026, employers will be required to pay their employees’ superannuation at the same time as their salary and wages; providing businesses with annual turnover of less than $50 million with an additional 20% deduction on spending that supports electrification and more efficient use of energy (the 'Small Business Energy Incentive'); and increasing the capital works tax deduction depreciation rate for eligible new build-torent projects from 2.5% to 4% per year. In addition to these, one of the most important aspects of this Budget was that the Government has provided some further depreciation relief for small businesses once temporary full expensing comes to an end on 30 June 2023. Specifically, from 1 July 2023 until 30 June 2024, the Government will temporarily increase the instant asset write-off threshold for small businesses (with an aggregated annual turnover of less than $10 million) from $1,000 to $20,000. Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool. Also, the provisions that prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended until 30 June 2024. Other important measures the Government announced include: amending (and limiting) the non-arm’s length income (‘NALI’) provisions which apply to expenditure incurred by superannuation funds; reducing the tax concessions available to individuals with a total superannuation balance exceeding $3 million; and exempting lump sum payments in arrears from the Medicare levy. In the ATO's sights this Tax Time The ATO has announced its three key focus areas for this Tax Time: rental property deductions; work-related expenses; and capital gains tax. ATO Assistant Commissioner Tim Loh said the ATO is continuing to prioritise areas where they often see mistakes being made: "Within these areas, we have identified common mistakes, and are particularly focused on addressing these and supporting taxpayers and registered tax agents to get their claims right this year." However, the ATO also recognises that many people are "doing it tough" this year, and expects fewer people will receive a refund, or they may receive smaller refunds than they were expecting, and more may have tax debts to manage. ATO advice regarding year-end trustee resolutions The ATO has advised that, in the lead up to 30 June, trustee clients who wish to make beneficiaries presently entitled to trust income for the 2023 income year should ensure their trustee resolutions are effective. This includes where trustees may want to make beneficiaries 'specifically entitled' to franked dividends and capital gains included in that income (i.e., where trustees want to 'stream' those classes of income to certain beneficiaries). It is important that trustee clients: check their trust deed to ensure that the intended beneficiaries are within the class of persons entitled to trust income (or of trust capital, if they intend to stream a capital gain that is not income of their trust) and are not excluded from being beneficiaries; comply with any requirements in the trust deed that concern how to validly 'appoint' (or distribute) trust income to beneficiaries; recognise that, for tax law purposes, beneficiaries need to be made presently entitled to trust income by 30 June of the relevant year; are aware that, if they fail to do what is required in a trust deed, or fail to appoint income by 30 June, this may cause outcomes to arise that differ to what they intended. This could include other beneficiaries being assessed on the relevant share of the trust's net (taxable) income (or the trustee being assessed at the top rate of tax); and ensure that resolutions are unambiguous. Side hustles' in the ATO's sights Editor: A recent ATO article highlights the fact that it is increasingly trying to bring more modern techniques of money-making into its tax net . . . ‘Side hustles’ have really grown over the past few years — everything from the gig economy and drop shippers, to content creators and influencers. The ATO recognises that it can be hard to know how to treat income when earning money from side hustles, especially when an individual has several, so the ATO has prepared some tips. First, the individual needs to know if they are 'in business'. If so, they may need to think about registration and tax obligations. If they are not in business, but are looking to start one, they should know how to "set themselves up for success". Also, if a side hustle means the individual is now a director of a company, they must make sure they apply for a director ID (which is free). ATO ride sourcing data-matching program The ATO will acquire ride sourcing data relating to approximately 200,000 individuals to identify individuals that may be engaged in providing ride sourcing services during the 2022/23 financial year. The data items include: identification details (driver identifier, ABN, driver name, birth date, mobile phone number, email address and address); and transaction details (bank account details, aggregated payment details, gross fares, net amount paid to driver, and all other income to which GST may or may not apply) of all payments received in the relevant period. The data will be used to identify and inform ride sourcing providers of their tax obligations as part of information and education campaigns. The intelligence obtained will increase the ATO’s understanding of the behaviours and compliance profiles of individuals and businesses that provide ride sourcing services, and may also be used as part of the methodologies by which the ATO selects taxpayers for compliance activities. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances.

Last chance to claim deductions under temporary full expensing Deductions under ‘temporary full expensing’ are only available in the 2021, 2022 and 2023 income years, and are expected to come to an end on 30 June 2023. Editor: Under temporary full expensing, businesses with an aggregated turnover of less than $5 billion can generally claim a deduction for the full cost of eligible new assets first held, used or installed ready for use between 6 October 2020 and 30 June 2023, as well as (in some circumstances) costs of improvements to those assets and also the cost of eligible second-hand assets. Taxpayers can choose to opt out of temporary full expensing for an income year for some or all of their assets, and claim a deduction using other depreciation rules, by notifying the ATO in their tax return that they have chosen not to apply temporary full expensing to those assets. Residential investment property loan data-matching program The ATO has advised that it will acquire residential investment property loan data from authorised financial institutions for the 2021/22 through to 2025/26 financial years, including: client identification details (names, addresses, phone numbers, dates of birth, etc); account details (account numbers, BSBs, balances, commencement and end dates, etc); transaction details (transaction date, transaction amount, etc); and property details (addresses, etc). The ATO estimates that records relating to approximately 1.7 million individuals will be obtained each financial year. The principal uses of the data include “education and online services” and “data analytics and insights”, as well as to help the ATO “identify relevant cases for administrative action, including compliance activities”. The ATO has a dedicated webpage dealing with its data-matching protocols (currently 24 in total). It states on this webpage that: “Matching external data with our own helps us to ensure that people and businesses comply with their tax and super obligations. It also helps us to detect fraud against the Commonwealth.” Electric vehicle home charging rates: cents per km The ATO recently released draft guidelines setting out a methodology for calculating the cost of electricity when an electric vehicle ('EV') is charged at an employee's or individual's home. The draft guidelines may be relied on by employers and individuals who satisfy the required criteria for FBT and income tax purposes respectively, as set out in the draft guidelines. The employer or individual can choose if they want to use the methodology outlined in the draft guidelines, or if they would like to determine the cost of the electricity by determining its actual cost. The choice is per vehicle and applies for the whole income or FBT year. However, it can be changed by the employer or individual from year to year. Cents-per-kilometre rate The rate for the FBT tax year or income year commencing on or after 1 April 2022 is 4.2 cents per km (the "EV home charging rate"), which is multiplied by the total number of relevant kilometres travelled by the electric vehicle in the relevant income year or FBT year. However, if electric vehicle charging costs are incurred at a commercial charging station, a choice has to be made: The EV home charging rate can be used, but only if the commercial charging station cost is disregarded. If the commercial charging station cost is used, the EV home charging methodology cannot be applied. Further, all necessary records (such as receipts) must be kept to substantiate the claim, as per normal record-keeping rules. Record keeping If a taxpayer wishes to rely on the EV home charging rate to calculate their electricity charging expenses, they will need to keep a record of the distance travelled by the car (i.e., generally odometer records) in either the applicable FBT year to 31 March or the income year to 30 June. Also, if an employer chooses to apply the draft guidelines and the EV home charging rate for FBT purposes, a valid logbook must be maintained if the operating cost method is used. If an individual chooses to apply the draft guidelines and the EV home charging rate for income tax purposes, to satisfy the recordkeeping requirements, they must have: a valid logbook to use the logbook method of calculating work-related car expenses (and it is recommended that a logbook is maintained to demonstrate work-related use of vehicles, regardless); and one electricity bill for the residential premises in the applicable income year to show that electricity costs have been incurred. Application It should be noted that the draft guidelines can only be relied on in relation to zero emissions vehicles. The draft guidelines cannot be relied on, and the EV home charging rate cannot be used, if, for example, the vehicle is a plug-in hybrid which has an internal combustion engine. Once finalised, the draft guidelines will apply from: 1 April 2022 for FBT purposes; or 1 July 2022 for income tax purposes. Taxpayers not carrying on an agistment business The Administrative Appeals Tribunal (‘AAT’) has held that two taxpayers were not carrying on a business of providing services to a company (which they owned) and consequently were not entitled to various deductions. The taxpayers had claimed those deductions on the basis that they were carrying on a business of providing agistment and full care animal husbandry and veterinary services to their company. The AAT concluded that, on balance, the agistment arrangements did not constitute a ‘business’. The AAT noted in this regard that there was a degree of systematic, business-like behaviour. However, the AAT was of the view that the absence of a profit-making purpose, the uncommercial nature of the transactions and similar considerations nevertheless led to the conclusion that a business was not being carried on. Know the rules for accessing superannuation The ATO has reminded SMSF trustees that their SMSF must be operated for the sole purpose of providing retirement benefits for its members. This means SMSF trustees can’t use funds from their SMSF to pay for personal or business expenses. This is known as 'illegal early access' of superannuation, and severe penalties apply. The ATO also reminds SMSF trustees that there are rules regarding what they can invest in when dealing with a related party. The ATO has recently released a factsheet to help SMSF trustees understand the rules on accessing their superannuation, and make sure they (and their business, if any) comply with the rules surrounding SMSFs. Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the

information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances. As the end of the financial year (EOFY) approaches, it's important for business owners to start preparing their finances and tax obligations to avoid any last-minute hassles. By taking a proactive approach and getting organised before the EOFY, you can ensure that your business is compliant with tax regulations and maximise your tax deductions. Here are some things to consider when preparing for EOFY:

By taking the time to prepare for EOFY, you can ensure that your business is in good financial health and minimize your tax liabilities. Don't wait until the last minute – start preparing now to make the most of the opportunities available to you. For more information or to schedule a consultation with one of our experienced accountants, contact us today. |

Archives

June 2024

Categories |

Quick Links |

Find Us |

Contact UsPhone: 07 4957 2231

Fax: 07 4951 4382 Email: [email protected] Visit: First Floor, City Plaza 45 Wood St Mackay QLD 4740 Mail: P.O. Box 16 Mackay QLD 4740 |

Follow Us |

RSS Feed

RSS Feed