|

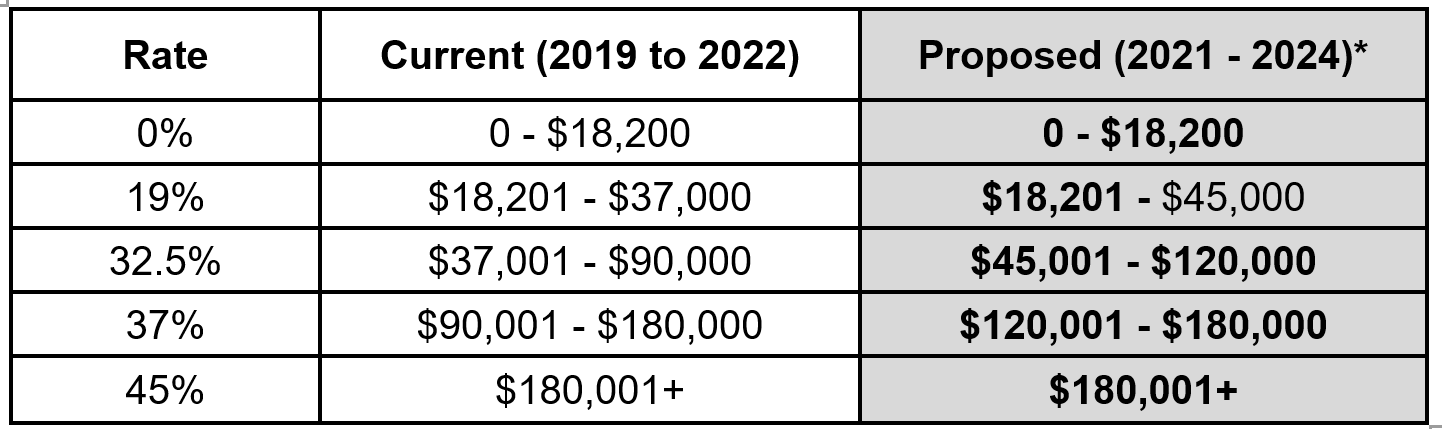

We summarise the below key changes announced in the Federal Budget that was delivered on 6 October 2020. This is for informational purposes and does not take the place of advice suited to your circumstances. Should you require any further information or explanation please contact your accountant at SH Tait & Co. INDIVIDUAL TAXPAYERS: Changes to personal income tax rates The Government has legislated to bring forward changes to the personal income tax rates that were due to apply from 1 July 2022, so that these changes now apply from 1 July 2020 (i.e., from the 2021 income year). These changes include:

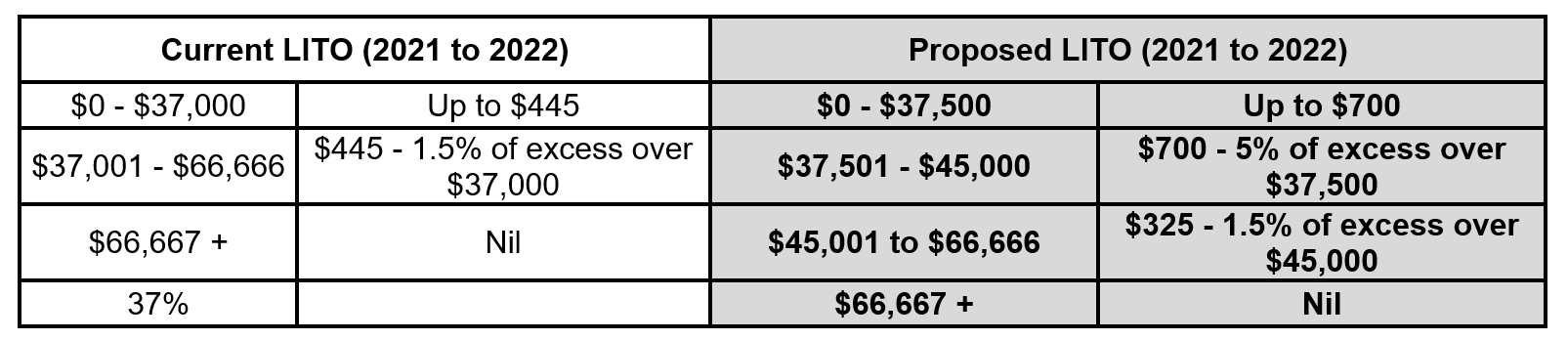

Employers are to reduce the tax withheld from 13 October 2020. Changes to the Low Income Tax Offset ('LITO') The Government announced that it will also bring forward the changes that were proposed to the LITO from 1 July 2022, so that they will now apply from 1 July 2020 (i.e., from the 2021 income year), as follows:

Note that, the Government also announced that the current Low and Middle Income Tax Offset (‘LAMITO’) would continue to apply for the 2021 income year (which is available in addition to the LITO for eligible taxpayers). For example, the maximum LAMITO of $1,080 will be available to taxpayers with taxable incomes of between $48,000 and $90,000 in the 2021 income year. BUSINESS TAXPAYERS: Expanding access to Small Business Tax Concessions The Government has announced that it will expand the concessions available to Medium Sized Entities to provide access to up to ten Small Business Concessions. For this purpose, a Medium Sized Entity is an entity with an aggregated annual turnover of at least $10 million and (less than) $50 million. The expanded concessions will apply in three phases, as follows:

The Government will introduce a JobMaker Hiring Credit to incentivise businesses to take on additional young job seekers. From 7 October 2020, eligible employers will be able to claim $200 a week for each additional eligible employee they hire aged 16 to 29 years old and $100 a week for each additional eligible employee aged 30 to 35 years old. New jobs created until 6 October 2021 will attract the credit for up to 12 months from the date the new position is created. The JobMaker Hiring Credit will be claimed quarterly in arrears by the employer from the ATO from 1 February 2021. Employers will need to report quarterly that they meet the eligibility criteria. The amount of the credit is capped at $10,400 for each additional new position created. Furthermore, the total credit claimed by an employer cannot exceed the amount of the increase in payroll for the reporting period in question (see employer eligibility requirements below). Who is an eligible employee? Employees may be employed on a permanent, casual or fixed term basis. To be an ‘eligible employee’, the employee must:

Who is an eligible employer? An employer is able to access the JobMaker Hiring Credit if the employer:

Uncapped immediate write-off for depreciable assets The Government has announced it will introduce the following changes to the Capital Allowance provisions:

CORPORATE TAX PAYERS INCLUDING PTY LTD COMPANIES: Temporary loss carry back for eligible companies The Government has announced that it will introduce measures to allow companies with a turnover of less than $5 billion to carry back losses from the 2020, 2021 or 2022 income years to offset previously taxed profits made in or after the 2019 income year. This will allow such companies to generate a refundable tax offset in the year in which the loss is made. The tax refund is limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry back does not generate a franking account deficit. The tax refund will be available on election by eligible companies when they lodge their tax returns for the 2021 and 2022 income years. Note that, companies that do not elect to carry back losses under this measure can still carry losses forward as normal. The application of these new measures to our corporate business clients will be considered during tax planning work performed in April / May 2021. OTHER BUDGET ANNOUNCEMENTS: Supporting apprentices and trainees The Australian Government is extending and expanding the Supporting Apprentices and Trainees wage subsidy, to include medium-sized business who had an apprentice in place on 1 July 2020. Eligible employers can apply for a wage subsidy of 50% of an eligible apprentice or trainee’s wages paid until 31 March 2021. · Your small business may be eligible if: · you employ fewer than 20 people; or · you are a small business with fewer than 20 people, using a Group Training Organisation; and · the apprentice or trainee was undertaking an Australian Apprenticeship with you on 1 July 2020 for claims after this date. Claims prior to 1 July 2020, will continue to be based on the 1 March 2020 eligibility date. · Your medium-sized business may be eligible if: · you employ fewer than 200 people; or · you are a medium business with fewer than 200 people, using a Group Training Organisation; and · the apprentice or trainee was undertaking an Australian Apprenticeship with you on 1 July 2020. Any employer (including all small, medium or large businesses and Group Training Organisations) who re-engages an apprentice or trainee displaced from an eligible small or medium business may also be eligible for the subsidy. Further information is available at https://www.australianapprenticeships.gov.au/search-aasn Small business COVID-19 Adaption Grant Program The objective of this program is to support small businesses subject to closure or highly impacted by the coronavirus (COVID-19) shutdown restrictions announced by the Queensland Government, to adapt and sustain their operations, and build resilience. The first round of funding for this program is 100% subscribed, however round two is currently open specifically to regional businesses, noting that subscription is nearing capacity. To be a 'regional business', your principal place of business must be in a local government area within Queensland that is not identified as a South East Queensland (SEQ) location. To be eligible, your business must:

In recognition of the significant impacts of COVID-19 on small businesses, the funding can be used towards meeting a variety of ongoing costs, including the following:

Modern Manufacturing Initiative This Modern Manufacturing Strategy (the Strategy) is led by industry, for industry, to help our manufacturers to scale-up, become more competitive and build more resilient supply chains. The Australian Government will be a strategic investor in this, in order to drive productivity and create jobs for Australians, both now and for generations to come. Key initiatives will deliver immediate and long-term economic benefits.

The program is targeted at growth opportunities in the following areas:

Insolvency reforms to support small business The Government will implement certain insolvency reforms, effective from 1 January 2021 (subject to the passing of legislation) to support small business, including the following:

0 Comments

Leave a Reply. |

Archives

June 2024

Categories |

Quick Links |

Find Us |

Contact UsPhone: 07 4957 2231

Fax: 07 4951 4382 Email: [email protected] Visit: First Floor, City Plaza 45 Wood St Mackay QLD 4740 Mail: P.O. Box 16 Mackay QLD 4740 |

Follow Us |

RSS Feed

RSS Feed